Electronic Invoicing

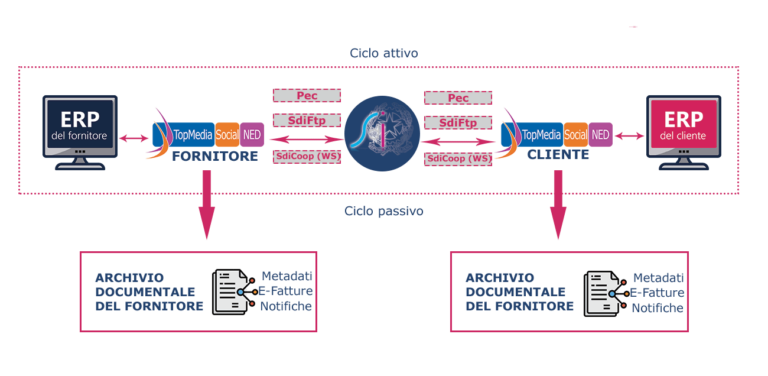

This solution manages all documents of account receivables and payables. It stores, sends and manages all receipts of XML electronic invoices.

On-Premise

Cloud

Service

Electronic Invoicing Solutions

Behind Electronic Invoicing, the real imperative for companies is Document Content Management. The invoice is in fact only one of the documents on which the administrative and production activity of the company revolves and it becomes more significant when perceived as a part of all documents that come before and after it (orders, delivery notes, payments, bank statements, reminders, registered emails, etc.)

The most correct solution is therefore to introduce Document Management to dematerialize and “correlate” all the documents in the supply chain, adopting a large and complete solution that digitizes the business processes related to the invoice and integrates them with all ERPs.

B2G ELECTRONIC INVOICING

From June 6th, 2014, electronic invoicing has become mandatory in Italy for all registered companies that have commercial relations with the Public Administrations.

B2B ELECTRONIC INVOICING

From January 1st, 2019, electronic invoicing has also become mandatory in Italy for B2B relationships.

EUROPEAN B2G ELECTRONIC INVOICING

From April 18th, 2020, electronic invoicing has become mandatory for companies that work with the Public Administrations of all member States of the European Union.

The opinion

B2G European Electronic Invoicing

Starting from April 18th, 2020, the Electronic Invoicing obligation will be in place for all companies that work with the Public Administrations of all member States of the European Union.

The format will be XML UBL; among the communication channels for transmission PEPPOL has been added. Already used for the management of electronic orders via the Order Sorting Node (NSO).

Top Consult has become an accredited Peppol Access Point, and studying the regulations of European countries is subsequently able to manage and transmit the other standardized documents in the UBL language.

Matteo Zaffagnini

Marketing Director Top Consult

Digital preservation of electronic invoices is mandatory!

Did you know that digital preservation is mandatory for electronic invoices, and besides this represents a great opportunity for the company?

With TopMedia Social NED customers can decide to keep the documents on premises, using the software and services designed by Top Consult, or to outsource the service to Top Consult.

In both cases, a complete dematerialization of tax archives will be achieved, saving space, time and, in the case of outsourcing, adding the security of a reliable and consolidated external service from long years of experience.

TopMedia Social NED solution for Electronic Invoicing

The document platform TopMedia Social NED is the ideal tool for sending and receiving electronic invoices, for managing exchange flows and the digital preservation that follows in accordance with the law. In addition, electronic invoices are massively digitally signed by TopMedia Social NED.

What are the benifts?

Account receivables

Account receivables send with Social NED the XML created by your ERP or provide the metadata; Social NED will create the XML and send.

Manage the flow of invoice

Receive the supplier invoice from the SDI Exchange System, manage the flow of invoice control with Social Flow by issuing and sending rejection or acceptance notifications to the SDI Exchange System, thus optimizing the Account Payables that works for all types of Invoices (XML or PDF).

Digitally signi n a massive way

Digitally sign all electronic invoices to the Public Administration in a massive way directly within the document platform.

Preserve digitally all customer

Preserve digitally all customer and supplier electronic invoices and their related notifications, either on premises complying with the law, or outsource to Top Consult the responsibility for the service for the entire mandatory period.